2018 In Review

As 2018 has drawn to a close, we want to take this opportunity to say thank you to our clients for their ongoing trust in our firm. We say this every year, but we’d be remiss if we didn’t reiterate the value we place in each one of our client relationships and the friendships we’ve made with all of you over the years. So once again, thank you. We also want to say thank you to the friends and advocates of Verdi Wealth Management, we sincerely appreciate your support.

2018…“It Was the Best of Times; It Was the Worst of Times”

The above paradox from the Charles Dickens classic, “A Tale of Two Cities”, best sums up 2018 from an investor’s perspective. Last year was certainly a frustrating year from an investing standpoint. If it was frustrating for us, then we realize it is exponentially frustrating for you the investor. Hopefully we did a sufficient job communicating and staying in front of you with our thoughts on all the ongoings in the markets, and how they relate to the strategy we have put in place to help you achieve your financial goals.

It was one of the truly great years in the history of the American economy, and by far the best one since the global financial crisis of 10 years past. At the same time, it was also a year in which the equity (stock) market could not get out of its own way.

It is almost impossible to site all the major data points of the economy which charged forward in 2018. Worker productivity surged. Wage growth accelerated in response to a rapidly falling unemployment rate. Household net worth rose above $100 Trillion for the first time, yet household debt relative to net worth remained historically low. And remarkably, the number of open job listings exceeded the number of people seeking employment.**

Earnings of the S&P 500 companies, paced by GDP growth and significant corporate tax reform, leaped upward by more than 20%. Cash dividends, up over 8% year over year, set a new record, and cash returned to shareholders since the bottom in 2009 has reached over $7 trillion. **

But the equity markets had other things in mind. The S&P 500, an equity index comprised of 500 of the largest, most profitable companies in America, opened the year at 2674, probably somewhat ahead of itself, as it seemed to be pricing in the entire future effect of corporate tax cuts all at once. We saw a correction in this index through February, but an upward surge ensued and it closed at an all-time high of 2930.75 in late September. It then gave way to a second correction, and after the worst December on record since the 1930s, the S&P 500 finished out the year at 2506.85.

The headwinds that caused the recent selloff have been well documented. Uncertainty about the future of the trade spat between the US and China has definitely caused investors to be nervous. The US imposed tariff of 10% on approximately $200 Billion worth of Chinese goods was set to jump to 25% on January 1st. This has been delayed for now, and China has agreed to purchase US agricultural and energy goods in an act of good faith. While the US definitely has a trade deficit with China, this is more of a battle over intellectual property (IP) theft by China from US companies, the current/future technology arms race between the two countries, and in many ways, a battle of cultural approaches to competing on a global scale.

While causing a headache for the US stock market, the tariff dispute, so far, has not hurt our GDP or our economy as a whole. If we go further down the rabbit hole, though, it would start to be a real hinderance, especially in regards to supply chain disruption, raw material costs, and negative sentiment towards American companies. This subject will once again be in the forefront throughout 2019, and we are hopeful that as the negotiations continue, progress is made, and some clarity is provided to help corporations and investors alike make more informed decisions.

These and other uncertainties, perhaps chief among them an uncertain Fed policy and an aging economic expansion, were weighing heavily on investor psychology as the year drew to a close. The real test will be when earnings numbers come in for Q1 of 2019, when the year over year comparison will already include the tax cuts. This will give us a much clearer picture of how corporations are performing, and provide guidance for the year ahead. In our minds, any forward looking slowdown has somewhat been priced into the market already.

In certain parts of the market, equities are priced almost as if we are already in a recession. Recessions are generally defined as 2 quarters of sustained negative GDP growth. Unlike equities, they are backwards looking, and we never know we are in one until we are. Stocks, being leading indicators, generally perform worse in the months leading up to a recession as compared the months when we are in a recession. We will eventually be in a recession again; they are a common part of the economic cycle here in America and abroad. Time will tell if this happens in 2019 or after.

For whatever it may be worth, our experience has been that negative investor sentiment and the resulting equity price weakness have usually presented the patient, disciplined long-term investor with enhanced opportunity.

So What Now?

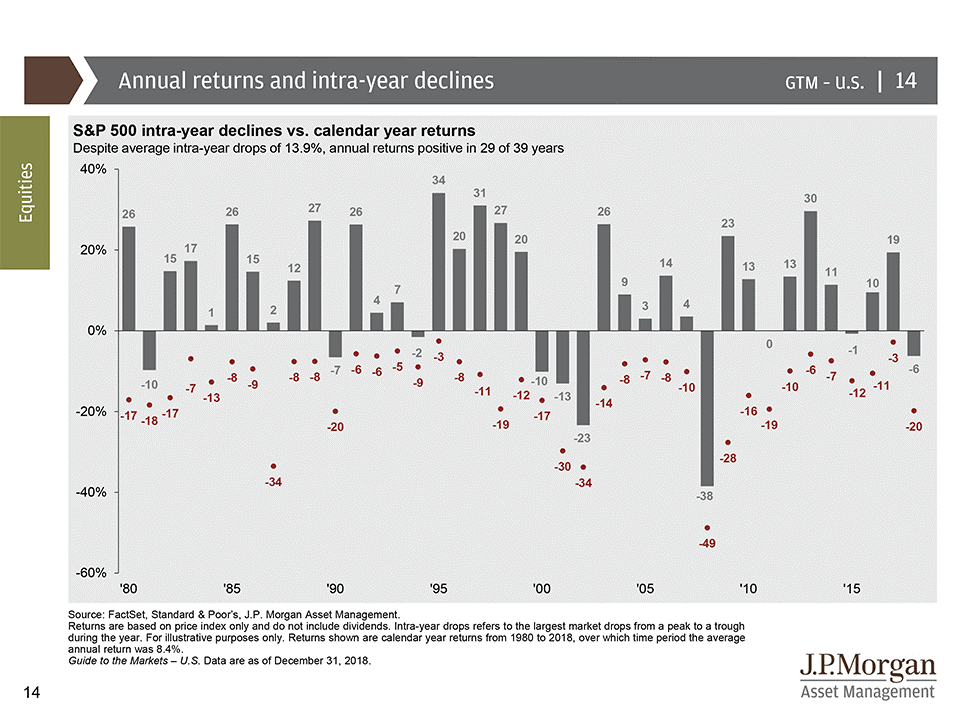

As we communicated in our August blog post “A Brief History of Buy and Hold”, selloffs like we just saw, and are still in the middle of, happen quite often, both at the individual stock level, and on the broad based index level. The S&P 500, going back to 1980, has an average intra-year decline of almost 14% (represented by the red numbers in the chart below). In 2018, that index had a downdraft of just under 20% from peak to trough. As you can see below, the S&P has had intra-year declines of 19% or more 8 times since 1980, or about once every 5 years. So while the 4th quarter decline in equities was rapid and sharp in its descent, it is by no means unprecedented.

In 1980, the S&P opened at a price of 107.94. It closed on December 31, 2018 at 2506.85. Amidst all of the chaos of the chart above, all the crises that we have encountered, multiple recessions, bear markets, wars, political turmoil, and economic downturns, the market continues to plunge ahead, just not in as smooth and linear a manner as one would like.

In the end, our long term investment success will be dictated far more by our behavior than by the specific investments we own, given that the specific investments we own are aligned with our short and long term financial goals and plan. As financial advisors, we neither forecast the markets nor attempt to time the markets in any way. Keeping a goal focused, well balanced portfolio, rebalancing when necessary, and staying level headed during difficult and euphoric times remain the keys to long term investing success. In short…faith, patience, and discipline will win out over time.

There are no shortage of pundits and prognosticators out there telling us exactly what is going to happen next week, next month, or even next year. Their job isn’t to be right, but to sell advertising and scare or excite us just enough to come back the next day to listen in. It is our job to filter out all of that noise and stay focused on the task at hand of helping you achieve financial success. We have been through times like this before, we will go through times like this again, and rest assured we will get past this once more.

We look forward to speaking with you soon. In the meantime, we encourage you to call us if you have any questions on this year-end summary, your investments, or anything else you wish to discuss. Best wishes for a happy, healthy, and successful 2019.

Sincerely,

Your Verdi Wealth Management Team

All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results. *Index returns provided by Morningstar. http://news.morningstar.com/index/indexReturn.html **Source: Nick Murray (January, 2019)