Recessions and Bear Markets

Are we in a recession? Are we headed into a recession? How bad will the next recession be? These are questions we have been hearing quite often as of late, especially as the Federal Reserve hikes interest rates to rein in inflation at 40-year highs. By the traditional definition (2 consecutive quarters of negative GDP growth), we entered a recession earlier this year. However, given the highly elevated GDP numbers at the end of last year as we exited the pandemic and the economy reopened, we believe those negative GDP quarters to be distorted.

The likelihood of a “real” recession has risen sharply in recent months. It is hard for us to see a clear path to bring inflation back down to the Fed’s 2% target without pushing the economy into a recession. The only way to break the spiral of escalating wages and prices is to create a lot of slack in the labor market. We ultimately need to see unemployment rise before wage growth starts to moderate.

Past recessions have occurred for many reasons, but typically are the result of economic imbalances that ultimately need to be corrected. Although painful to live through, you cannot have a sustained period of growth without an occasional reset. We know this to be true because it happens every 6-10 years. It’s normal, it’s expected, and it is healthy long term.

What should we do if we slide into a recession? Stay calm. Recessions typically coincide with bear markets (a drop of 20% or more), which we are in currently with the S&P 500 being down 20% year-to-date and 25% at its low. During market stress, emotions raise their ugly heads and can be one of the biggest roadblocks to strong long term investment performance. History has shown that picking the exact start date or end date of a recession or bear market is next to impossible.

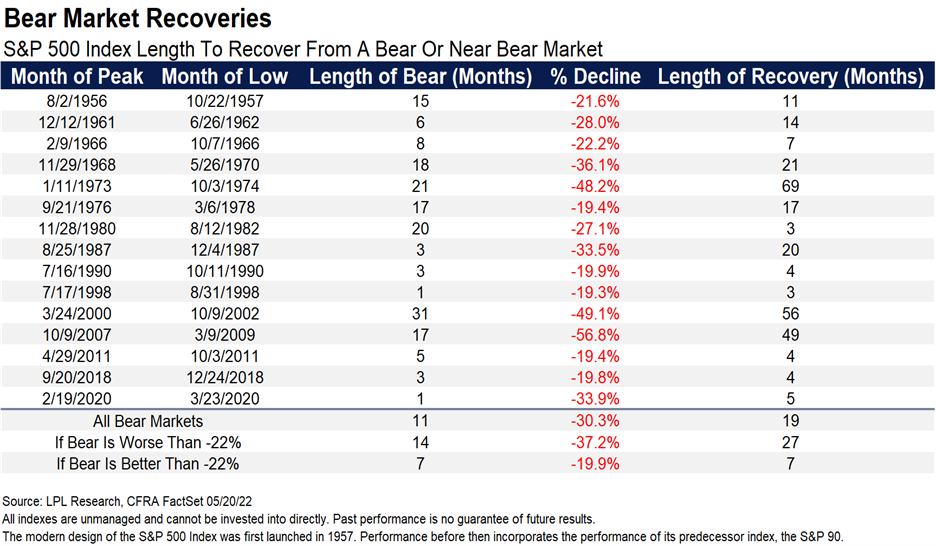

The below chart shows every bear or near bear market for the S&P 500 going back to the 1950s.

The key takeaway from this chart is that bear markets have been relatively short compared with most investors time horizons, with the average bear market lasting 11 months.

Investing defies certainty. We do not know how long any recession or bear market may last or how long equity market recoveries may take. Indeed, official declarations of recessions by NBER (National Bureau of Economic Research) are backward-looking. A recession can end before it’s been declared, reflecting the challenge economists face in assessing the level of growth in real time.

Our Consistent Counsel: We truly understand the pain that our clients feel during difficult times. History has shown that the markets are not linear and bear markets are quite normal. Whether we are in a recession currently or not, we need to stay the course and avoid overreacting to the latest economic news and stick with our long-term investment plan. There is no evidence that efforts to time the markets reward investors. Quite the opposite, in fact.

We have been through several bear markets in our career, and they are never fun. It is our goal to help our clients get through not only the market turmoil but also the emotional turmoil and reassure them that there will be blue skies ahead, as history has always proven. Hang in there – we will all get through this together. Please call us if you have any questions or concerns.

Sincerely,

Your Verdi Wealth Management Family