2025: A Year of Resilience

Despite a year dominated by unsettling headlines—ranging from shifting trade policies and tariff uncertainty to a new administration and a temporary government shutdown—equity markets delivered strong results. The S&P 500 posted a total return of 17.9% for 2025, underscoring a familiar lesson for long-term investors: while headlines drive short-term volatility, market performance is ultimately grounded in fundamentals.

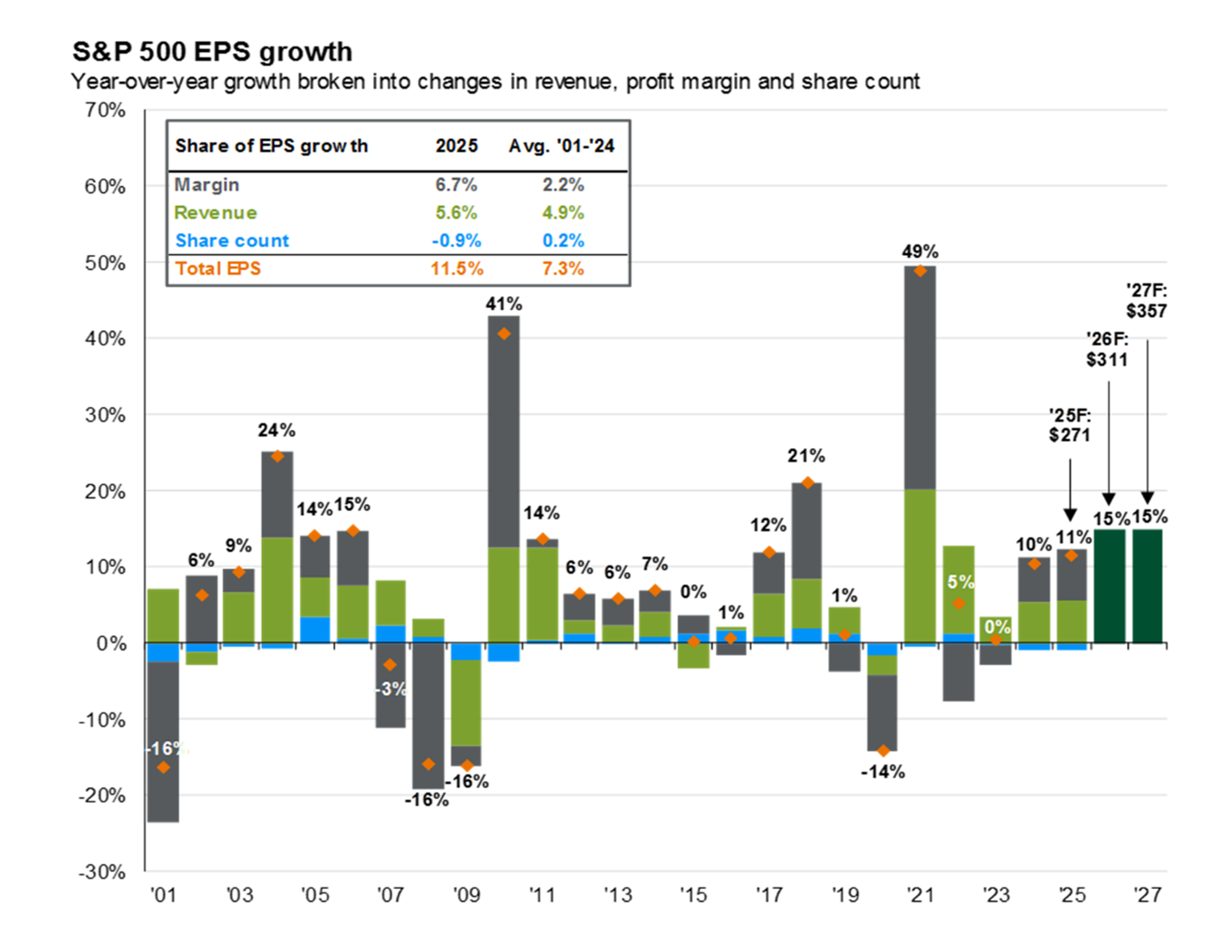

The primary driver of 2025’s returns was earnings growth. S&P 500 earnings per share have increased approximately 11.5%, supported by continued investment in artificial intelligence and improving operational efficiency. In an environment marked by uncertainty, the profitability of U.S. businesses remained resilient.

Over time, earnings growth is the most important determinant of stock prices. While sentiment, economic data, and geopolitical events can influence markets in the short term, stock prices tend to follow earnings over longer periods. Total equity returns generally reflect three components: earnings growth, dividends, and changes in valuation. While valuations can fluctuate, they tend to normalize over time, leaving earnings growth as the primary driver of sustainable returns.

History reinforces this relationship. From 1970 through 2024, S&P 500 earnings grew at an annualized rate of just over 7%, while total returns averaged approximately 11%. Dividends and valuation changes contributed, but earnings growth formed the foundation.

Looking ahead: The S&P 500 earnings are expected to end 2025 growing approximately 11.5%, with consensus estimates pointing to roughly 15% growth over the following two years. This outlook may appear surprising given the persistent negative news cycle, but the explanation lies in margin expansion.

While revenue growth and share buybacks are still near long-term averages, profit margins have expanded more rapidly (see chart below). A key contributor has been the adoption of artificial intelligence to improve productivity, reduce costs, and enhance pricing discipline. AI investment also accounted for an estimated 1.1 percentage points of U.S. GDP growth in the first half of 2025, highlighting its growing economic impact. Although the adoption of AI is still in its early stages, its influence on corporate efficiency and profitability is already clear. As with any transformative technology, periods of excess and volatility are inevitable. However, history suggests that companies using innovation to strengthen margins and grow earnings sustainably are best positioned to deliver long-term shareholder value.

Although the adoption of AI is still in its early stages, its influence on corporate efficiency and profitability is already clear. As with any transformative technology, periods of excess and volatility are inevitable. However, history suggests that companies using innovation to strengthen margins and grow earnings sustainably are best positioned to deliver long-term shareholder value.

In a market often driven by emotion and headlines, 2025 provided a prompt reminder that fundamentals are still the most reliable guide for long-term investors.

Please let us know if there is anything we can do for you, and we hope you have a healthy, happy, and prosperous 2026!

Sources: Compustat, FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Historical EPS values are based on annual earnings per share.

Disclosures: Forecasts for 2025, 2026 and 2027 reflect consensus analyst expectations, provided by FactSet. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. All indices are unmanaged and are not available for direct investment by the public. Past performance is no guarantee of future results.