Corona Virus, Economic Fallout, and Thoughts on Kobe

By now, most everyone has heard about the Wuhan Corona Virus that originated in China and has spread to other parts of the world. While the data is rapidly changing, we do know that there have been more than 70,000 reported cases, and over 2,000 deaths. Given that many parts of China are under quarantine, and the lack of medical facilities in rural parts of China, those numbers are likely underestimating the number of actual people infected.

What does this mean for the economy and the markets? Most likely, this viral outbreak will cause a slowdown in Global GDP. Some areas, mainly China and neighboring countries such as Thailand and others that rely heavily on Chinese tourism, will get hit the hardest from an economic standpoint. Here in the US, airlines have cancelled flights to China, and although we have had very few cases of the virus compared to other parts of the world, worries persist.

From an investing standpoint, certain industries are hit harder than others. Inside of China, a large part of their GDP comes from manufacturing. Companies that do business in China have had to put a pause on factory production or even close stores. For instance, Starbucks has temporarily closed about half of it’s 4,300 stores, and Apple has closed all of it’s stores. The Chinese consumer is a big revenue source for a lot of companies, and this is sure to hinder earnings for anyone that does business there. If that’s the case, then why haven’t we seen a precipitous fall in these company’s share prices? It is no guarantee, but investors in general believe this virus will be contained soon and business will be back to normal by the 2nd half of this year. That being said, we do expect more volatility as this story develops.

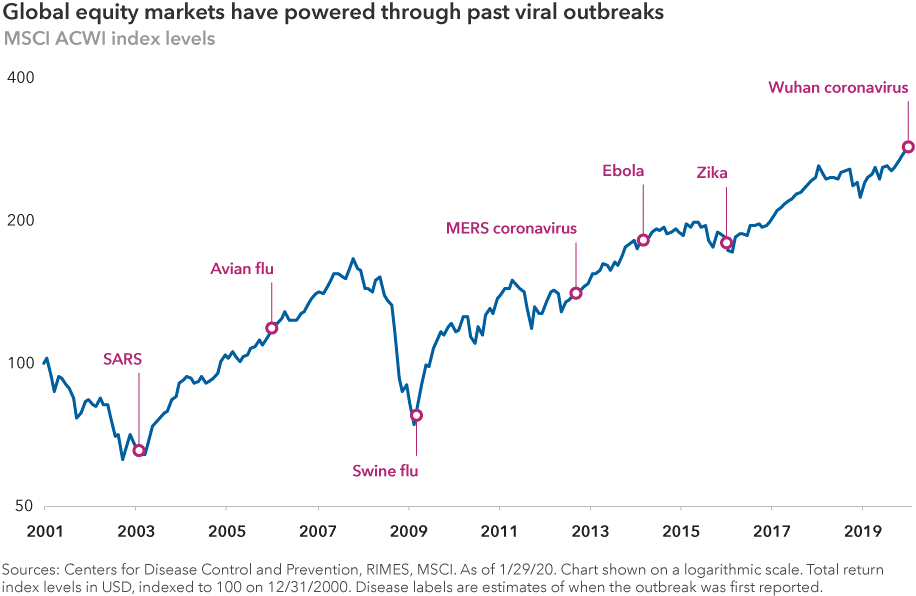

When it comes to the world dealing with viral outbreaks, this is certainly not our first rodeo. Take a look at the chart below from The Capital Group. We have seen more than a handful of outbreaks over the last 20 years, and while each temporarily slowed economic growth, in the long term they didn’t halt the continued climb of equity prices over time. Our belief is the effects felt from the Corona Virus will be no different.

While we don’t know what the future holds, we do know recent history. As of February 10th, 318 companies, or almost 80% of the market capitalization of the S&P 500, have reported quarterly earnings. Of those that have reported, 71% have beaten the consensus estimates on earnings, and 50% have beaten consensus estimates on revenue. Unemployment rates remain at or around historic lows, and interest rates remain stable and low. With all of that taken into account, it makes sense that US equity markets continue to climb the wall of worry. We’re hopeful that the Corona Virus is contained by the middle of the year, those that are sick are given the necessary treatment to get better, and it’s back to business as usual for the global economy.*

Switching gears, I wanted to write a short note in remembrance of the passing of Kobe Bryant who along with his daughter Gianna and 7 others tragically passed away in a helicopter accident on January 26th.

I was born in 1981 in Milwaukee, WI. I grew up a rabid Milwaukee Bucks fan and was lucky enough to be a kid when Michael Jordan entered the league. I didn’t get to go to many games, but for as long as I can remember, my dad would make it a point to get us tickets when Michael Jordan came to town. They weren’t the best tickets, and sometimes we had to walk a mile or more in below zero-degree weather, but it was worth it.

You can’t define greatness, but Michael Jordan had it. The stadium was sold out and electric before warmups even started. When Jordan entered the stadium, the place erupted, even if it wasn’t his hometown. It was an amazing experience. You can’t explain it unless you’re there, but I was witnessing greatness. From the time he entered the arena, the Bucks never stood a chance. Jordan knew it, the Bucks knew it, and everyone in the stadium knew it. He was as unstoppable an athlete as there has ever been.

I’ve been to a lot of different sporting events in my life, and the only other time I have had that feeling is watching Tiger Woods live. I saw him play his first pro tournament ever at the Greater Milwaukee Open, saw him at various tour events throughout his career, and was lucky to see him last year at the Masters where he won. The crowds, the mystique, his competitors folding around him, and his ability to have every single person at the event rooting for him are all an absolutely incredible sight to see in person. Again, you can’t explain it unless you’ve been there, but it’s greatness.

I grew up a Jordan fan, and was never really a Kobe guy. In my generation, you couldn’t be both. He touched people on a global basis though, and I imagine that his fans throughout the sports world felt about him the way I and many others look at Jordan and Tiger. Those guys were my heroes as a kid, as Kobe was to many over the last 25 years or so. He was never the most talented or athletic, but he worked harder than anyone at his craft and was as ruthless a competitor as there ever was. Entering the NBA out of high school, he ended up playing for the Lakers for 20 years and had the unwavering loyalty of their fans. He won 5 championships, was an 18 time All Star and is the 4th leading scorer of all time. Yes – he had his faults, some very well documented and in the public eye. But he will be missed. Greatness comes around only so often and there just won’t be many more people like him in the sports world in our lifetime.

If there is a musician, athlete, artist, political figure, or anyone else that you may feel this way about, my advice is to go see them in person if you have the means. Greatness is an amazing thing to be around.

– John W. Gottschall, CFP®

Source: JP Morgan*