MMQH: Inverted Yield Curve

Monday Morning Quick Hits:

The Stock Market continues to show signs of nervousness. The Market is struggling with news-driven doubts such as Britain’s Brexit fight, US-China trade war and now an inverted yield curve.

Last Wednesday, the yield on 2 year Treasury note and 10 year Treasury note became inverted. In other words, investors would get a higher yield (or interest rate) buying 2 year debt vs. buying 10 year debt. Generally speaking, the longer you would loan someone money for, the more at risk you are of them not paying you back, so in turn you charge a higher amount. That is why an inversion such as this is a weird phenomenon. It goes against common sense.

This rarely happens, but when it does, it has historically been a predictor of a looming recession. In fact, it has preceded every recession over the last 50 years. An inverted yield curve does not cause a recession, it is simply a data point that has been accurate in predicting one. And as we saw last Wednesday, it caused a substantial selloff in the equity markets.

What Causes An Inverted Yield Curve?

There are many theories as to why this happens, but what happened last Wednesday (and what has been brewing for a while) can be chalked up to global investor nervousness about future growth. Another factor for declining US rates is institutions such as central banks are mandated to purchase sovereign debt and other developed countries sovereign debt provide little to no yield, or even negative yield. There are no other viable options for investing in sovereign debt in the developed world. This has increased demand for relatively safe, long-term Treasuries, which in turn pushes down long-term rates. Remember, bond prices are inversely correlated to interest rates, so as demand increases, prices go up, which pushes rates down.

Does This Mean We Are In A Recession?

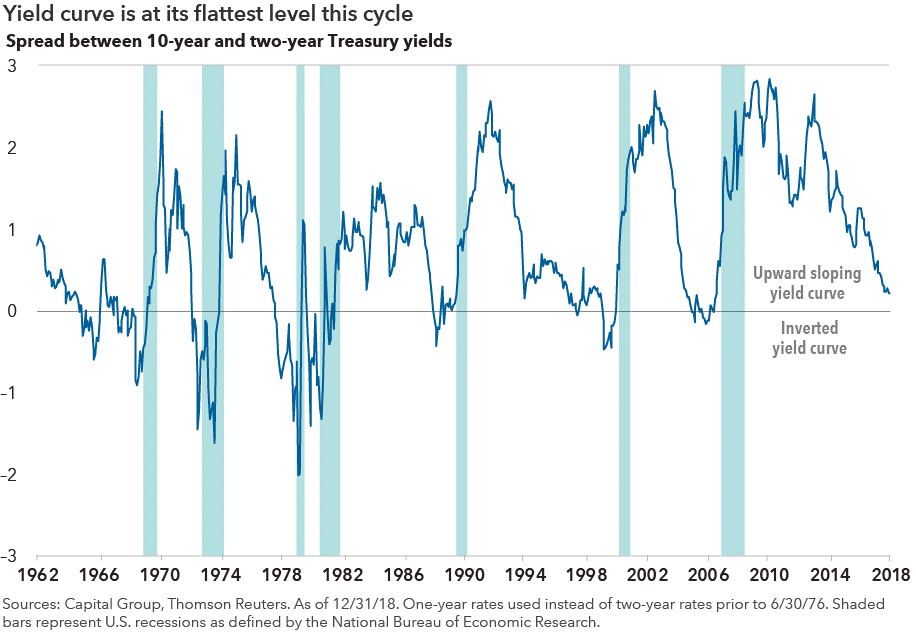

No. It also doesn’t guarantee there will be one in the near future either. This inversion did not even last a day. Inversions of the past have lasted weeks or months. The chart below shows every recession we have had since the 1960s overlapped with the historical yield curve. There is typically a lag of an average of 16 months before we know we are in a recession, so there’s no cause for immediate panic.

If There Is No Cause For Immediate Panic, Why Did the Market Sell Off?

Equities, being leading indicators, are always priced on a forward looking basis. The market sold off because investors are looking at what is going to happen 12 months from now. If we are in a recession, consumers will be spending less, leading to lower earnings for corporations. Current data, however, shows that this has not started to happen yet. In fact, both Walmart (the American consumer), and Alibaba (the Chinese consumer) both posted extremely strong quarterly earnings last week. These are only two companies, but given their size and scope, can be a good barometer on the overall health of the economy both here and in China.

As we have stated in the past, recessions come and go, and are a normal bi-product of capitalism. Rational behavior during volatile markets remains the key to long term investment success, and this time is no different.

Please let us know if you have any questions on this or if there is anything we can do for you. Have a great week!