Rising Inflation – Temporary or Here to Stay?

2021 is shaping up to be an interesting year. I think we are all happy to start seeing the light at the end of the tunnel, as we have started to reconnect with our families and friends and get back to a more normal routine at work and at home. From where we sit, it has been a joy to having more frequent in-person meetings over the last few months and reconnecting with our clients face to face.

In the world of finance, we have seen the early effects of what has and what will continue to dominate the conversation throughout the year – that is rising interest rates and rising inflation. Are rising rates and rising prices on goods and services here to stay? Or will this be more of a temporary higher-inflationary environment?

How We Got Here

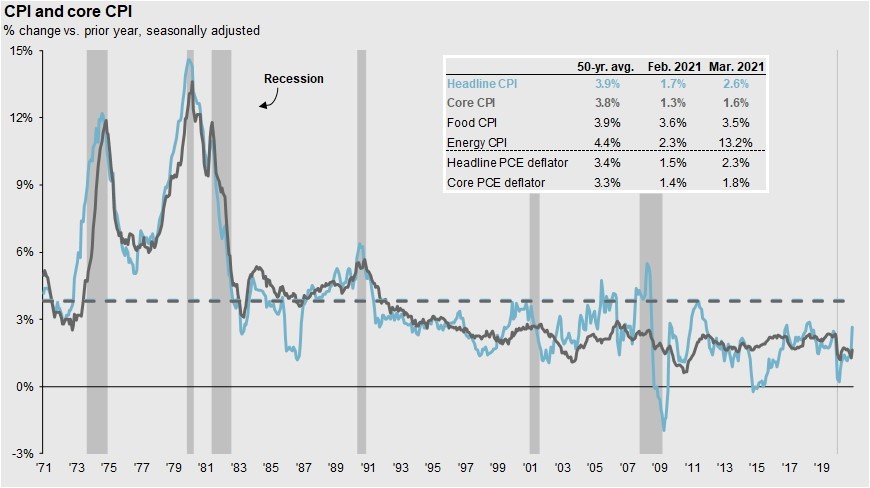

First, let us keep things in perspective. Headline CPI and Core CPI are still below historic norms. Headline CPI includes items such as food and energy, which historically can be very volatile (remember $0 oil?). Core CPI does not include those items. In the short term, these two measures can separate a bit, but as we can see in the chart below from JP Morgan, over the long term the data converges. 1

There are a multitude of reasons we are seeing inflation creep back into our lives, including the rising cost of energy as the economy re-opens. In our view, one of the main culprits was the rapid increase of the money supply during the mandated economic shutdowns.

There are a multitude of reasons we are seeing inflation creep back into our lives, including the rising cost of energy as the economy re-opens. In our view, one of the main culprits was the rapid increase of the money supply during the mandated economic shutdowns.

Global supply chains are extremely complicated and are not something governments can just turn off and on with a switch. But what happened last year was about as close to this as we have ever seen. The economic shutdowns combined with economies being flooded with stimulus money caused a sizeable supply/demand imbalance, which has helped lead to higher prices almost everywhere we look. In other words, too much money chasing too few goods.

The price of lumber is up 348% year over year. Corn is up 138% and aluminum is up 67%.2 There is a global semiconductor shortage, and in today’s world, computer chips are used in almost everything we use. There are other factors at play as well in regard to semiconductors, but nonetheless, there is a global shortage and they are essentially the new oil. This has crept into our daily lives, as our dollar does not go as far as it did pre-pandemic, and the lag time for certain goods and services has become very frustrating.

Shop ‘til You Drop

Most of us are sick of staying at home and are ready to go out into the world and spend money again. And as a country, we have more money to spend than probably ever.

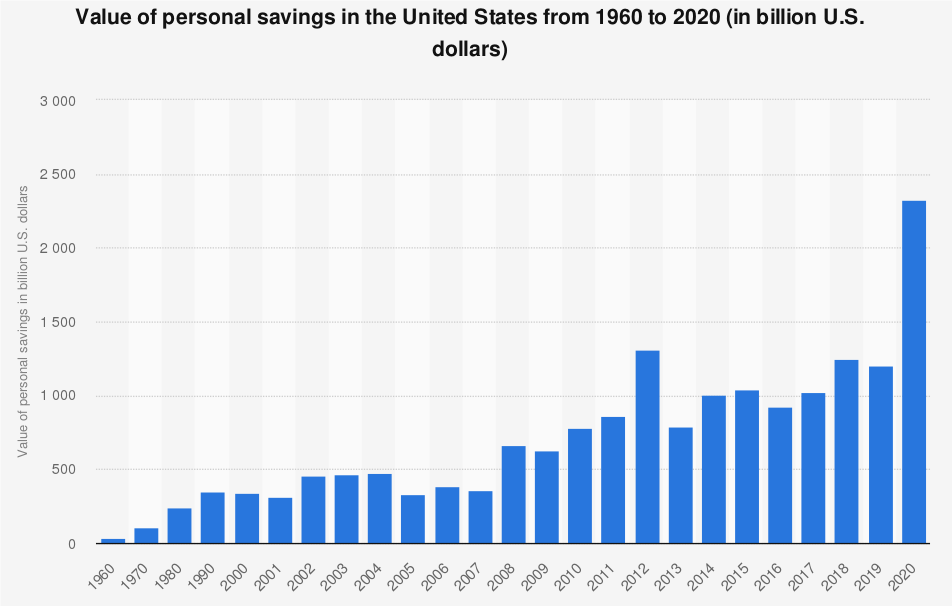

The above chart3 shows the historical personal savings rates over the last 60 years. Economic shutdowns and government stimulus helped to push the 2020 savings rate to over 2.3 trillion dollars, almost double the amount in 2019. As a % of disposable income, this amounts to 12.9% vs. a longer-term average of around 6.5% (1990-2019).4

As more and more Americans receive the vaccine, we come closer to the economy reopening to something close to its full economic potential. Some industries will recover faster than others, but with each passing day, economic forces are being exerted as consumers go back to traveling, shopping, eating out, and spending at large. On May 3rd last year, only 163,692 people went through a TSA checkpoint, compared to 2,470,969 in 2019. That number has climbed to 1,626,962 on May 3rd of this year. People are starting to travel again, and we believe the 2019 comparable will continue to slowly climb.5

Many corporations followed suit last year as well. With record low interest rates, companies were able to secure liquidity in the face of an unknown future due to the pandemic. For investment grade companies, the median cash ratio (a measure of cash and cash equivalents to current liabilities), ended 2020 at 33.3%, an increase from 19.3% at the end of 2019.6

With ample liquidity and a clearer economic picture in sight, corporations have started to go back on offense and increase their capital spending. This includes paying down debt, capital expenditures, and returning money to shareholders, including reinstating or even increasing their dividends. In April 2020, two dozen companies in the S&P 500 reduced or suspended their dividends. More suspensions and dividends came later in the year. In April 2021, the opposite happened: 33 companies in the S&P 500 announced dividend increases. None announced a decrease, and none have suspended dividends.7

The Big Question

The question investors now face is will the rise in interest rates and inflation be temporary, or more structural and permanent? Federal Reserve Chairman Jerome Powell recently expressed his view that a rise in inflation is due to the economy regaining its footing and will be temporary. He stressed that the initial offset of supply and demand will ultimately find an equilibrium in most areas of the economy over the medium term. The U.S. 10-year treasury has steepened greatly since March of last year, with its yield going from a low of around 0.5% to around 1.6% currently. How high will the ten-year go is anyone’s guess.

What could push it higher is if the Fed were to stop its current quantitative easing program, in which the Fed has been buying US treasuries and mortgage-backed securities on the open market each month in order to provide liquidity through the pandemic. Combine that with continued expansion of the money supply, hard-to-find labor and a pullback from free trade and globalization, and higher rates/prices is what we will have.

On the flipside, what could help to stabilize rates is the fact that other developed sovereign nations with extremely low interest rates will be more than happy to purchase our bonds. Germany, Netherlands, and Switzerland still have negative yields on their 10 Year debt. Japan, the largest foreign owner of our debt, is at 0.09% and France is at 0.14% (as of May 6th).

Long Term Perspective

Inflation is not necessarily a bad thing for equities and investors alike. It remains to be seen how this will play out over the next few years, and what effect it will have on the equity markets. We will explore this topic and more in our next email. In the meantime, if there is anything we can do for you, please let us know.

1-JP Morgan Guide to the Markets 2- Nasdaq.com 3- St. Louis Fed, BEA, Statistica 2021 4- Capital Group 5- tsa.gov 6- spglobal.com 7- cnbc.com