Verdi Wealth Management Mid-Year Report

As the first half of 2018 has come to a close, we want to take this opportunity to thank all of our clients for their ongoing trust in our firm as the steward of their family’s precious resources. We truly value each and every one of our client relationships and the friendships we’ve made over the years. We also want to thank those of you that are not clients (yet!), for your ongoing advocacy and support of our business.

What a year it’s been so far. So much has happened, yet so little has happened. Coming off the heels of the Tax Cuts and Jobs Act Bill passed in December of last year, corporations responded by ramping up spending on their businesses at the fastest pace in years. Led by the technology sector, capital expenditures by S&P 500 companies totaled about $167 Billion in the first quarter, the fastest pace in seven years. With the help of lower tax rates, first quarter after-tax earnings for S&P companies were up 25.3% over the same period in 2017, according to Thomson Reuters, which is the strongest gain in more than seven years. *

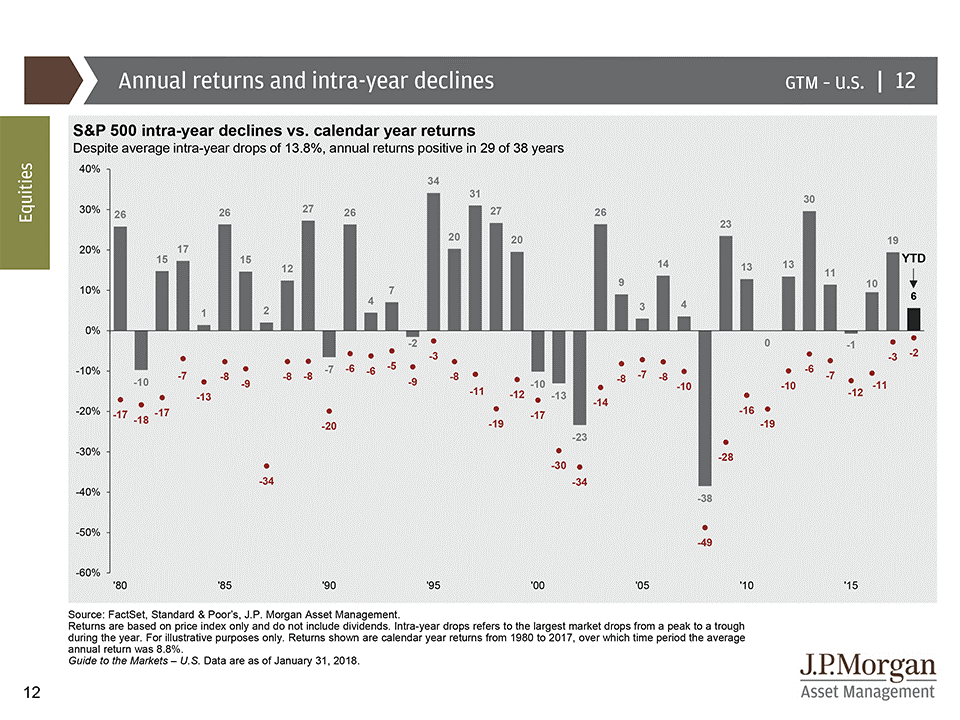

As you recall, even with all of that positive news, the broad US indexes saw their first correction (a drop of approximately 10% or more) in over 2 years. While not historically unprecedented, that length of time without meaningful volatility has been very rare over the last 40 years or so.

Below is an updated version of a chart we sent out earlier this year showing the intra-year declines vs. the overall return for each year of the S&P 500 index. The grey bars represent the % return for the year, and the red numbers represent the intra-year declines (The data is only through the end of May). As you can see, going back to 1980, the average intra-year decline in the S&P 500 is approximately 14%. This means each and every year, on average, the S&P 500 index, at some point, falls 14% from peak to trough. As we stated back in March, we were due for more normalized volatility this year.

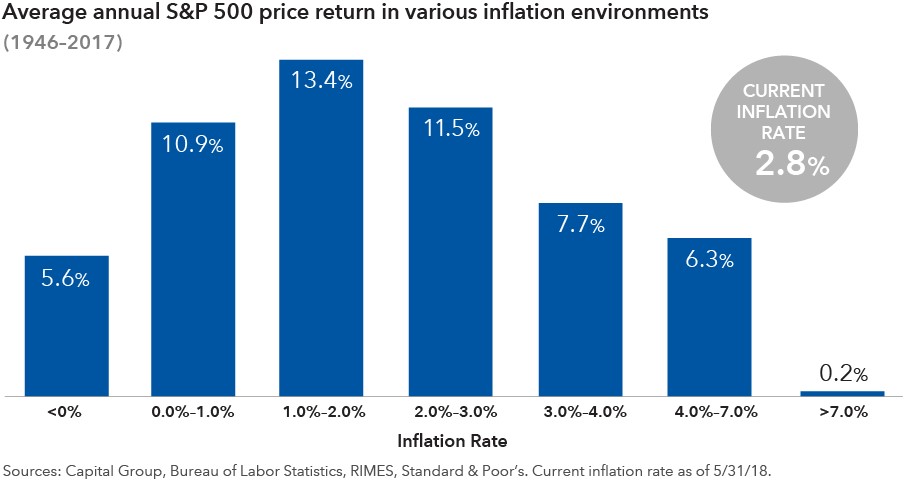

The main culprit for the selloff back in February, in our opinion, was interest rates. The threat of higher inflation stoked fears of rapidly rising rates. While more normalized rates are a sign of a healthy economy, they can sometimes be detrimental to equity returns in the short term, especially high yield investments and companies that rely heavily on debt for growth. An increase in the cost of borrowing is a hindrance on profits, all other things being equal.

But what about long term? How do equities perform in different inflationary environments? We found this great chart (below) showing average returns for the S&P 500 at different levels of inflation, going back to 1946. There is a point of no return in regards to inflation and equity returns, but as you can see, we are nowhere near that yet.

The market recovered somewhat from the selloff back in February, and as we stated above, first quarter after-tax earnings growth was the best it’s been in quite some time. But volatility has seeped back into the system, and in recent weeks has picked up quite a bit. What now?

Tariffs & Trade Wars

While we could dedicate an entire white paper to this subject and debate the economic merits of what is happening or at least proposed, we will keep it as short and simple as possible and focus on what it means for investors in the short and long term.

Tariffs on a broad scale could eventually morph into a threat to American’s finances that may go beyond paying a little extra for certain everyday items that are expected to rise in price due to increased border taxes. The latest threat of taxing an extra $200 Billion of Chinese goods could potentially put jobs and investment portfolios at risk if the trade tiff intensifies and a “true” trade war ensues.

The big risk is if President Trump’s pre-emptive strikes are followed by continued strikes by China and others, such as Canada, Mexico, and the European Union, causing the disagreements to spiral out of control and ultimately cause fear for investors and undermine confidence in the global economy and the markets. It is well known that Harley Davidson has said they may move production to Europe to combat imposed tariffs that would increase the cost of bikes bought by Europeans. They sold over 40,000 bikes into that region last year, making it their most important market outside of the US. This is a major problem that unilateral tariffs may cause to certain corporations throughout the US.

There is a lot more at stake here than just price inflation. A trade war on a large scale could cause the economy to slow and undo much of the economic good set forth in December by corporate tax cuts.

In the short term, the escalating trade war talk has caused a sell-off in certain of the areas in the market, most notably technology and big multi-national firms who generate a significant amount of profits overseas, especially in China. The Chinese equity market has faired much worse, with the benchmark Shanghai Composite index entering bear market territory (a drop of 20% or more) as recently as June 27th. (One can conclude that either this index was overvalued and the fall is justified, or China has a lot more to lose than the US does. It is probably some combination of both)

Companies in the S&P 500 rely on foreign markets for about a third of their revenue. According to Bank of America strategists, a 10% increase in import costs from trade tariffs would reduce the S&P 500’s per-share earnings by 3-4%. A separate Goldman Sachs study puts the hit to per-share earnings at 2-3%. * In the long term, earnings growth is what drives stock prices higher. So a lot of the growth in earnings gained because of the corporate tax cuts (see above) could be reduced or nullified.

So What Now?

We are hoping that cooler heads will prevail and that the end result won’t cause or fast forward us towards a global recession. The markets are hoping that the back and forth trade skirmish is just a negotiating tactic by President Trump that will end with the US receiving better trade terms. In the meantime, the economy is still very healthy, and there are sectors that will be harmed less than others should a trade war ensue, most notably small and mid-cap size companies. These companies generate significantly less profits overseas than their large cap counterparts, which makes them more immune to border tax wars.

Our job is to filter out the daily hyperbole and noise that is endemic to Wall St, and stay focused on helping our clients achieve their long term investment goals. Keeping a well balanced portfolio, rebalancing when necessary, not being afraid to take profits, and staying level headed during difficult and euphoric times remains the key to long term investing success.

We will be following up this report soon with an update on the tariff situation and where we’re at in terms of valuations. In the meantime, if there is anything we can do for you, please give our office a call at 208.331.7858. We hope you have a fun and safe 4th of July holiday!

-Your Verdi Wealth Management Team

*Sources: Bloomberg, The Capital Group, J.P. Morgan Asset Management